Simplify IFTA Reporting Forever

Automatically calculate fuel tax across all jurisdictions. Track mileage by state, manage fuel purchases, and generate quarterly IFTA reports in minutes instead of hours.

No credit card required • 30-day free trial • Cancel anytime

IFTA Filing Doesn't Have to Be Painful

Stop spending hours on spreadsheets every quarter

The Old Way

- ✗Manually tracking miles in each state with paper logs

- ✗Collecting and organizing fuel receipts from multiple states

- ✗Complex spreadsheet formulas that break or have errors

- ✗Hours spent reconciling data every quarter

- ✗Risk of audit penalties from calculation mistakes

With Truck Command

- ✓Automatic mileage tracking from your load records

- ✓Fuel purchases logged with state automatically detected

- ✓Instant calculations for all 58 IFTA jurisdictions

- ✓Generate quarterly reports in under 5 minutes

- ✓Audit-ready documentation always available

Complete IFTA Solution

Everything you need to stay compliant and save time

State Mileage Tracking

Automatically track miles driven in each state. Data syncs from your load records for accurate reporting.

Fuel Purchase Logging

Log fuel purchases with state detection. Track gallons, prices, and receipts for complete fuel tax documentation.

Automatic Calculations

Instant MPG calculations by jurisdiction. Tax owed or credit due calculated automatically based on current tax rates.

Quarterly Reports

Generate professional IFTA reports ready for filing. All data formatted exactly how your state requires.

Multi-Vehicle Support

Track IFTA data separately for each truck in your fleet. Filter reports by vehicle or view combined fleet totals.

Export Options

Export reports as PDF or CSV. Compatible with state filing systems and perfect for your records.

How IFTA Tracking Works

From driving to filing in four simple steps

Drive & Deliver

Complete your loads as usual. State mileage is tracked automatically from your dispatching records.

Log Fuel

Enter fuel purchases with location. State is detected automatically, gallons are tracked for each jurisdiction.

Review Data

View your quarterly summary by jurisdiction. MPG, taxable gallons, and tax due are calculated instantly.

File Report

Export your IFTA report and file with your state. Keep documentation for audit protection.

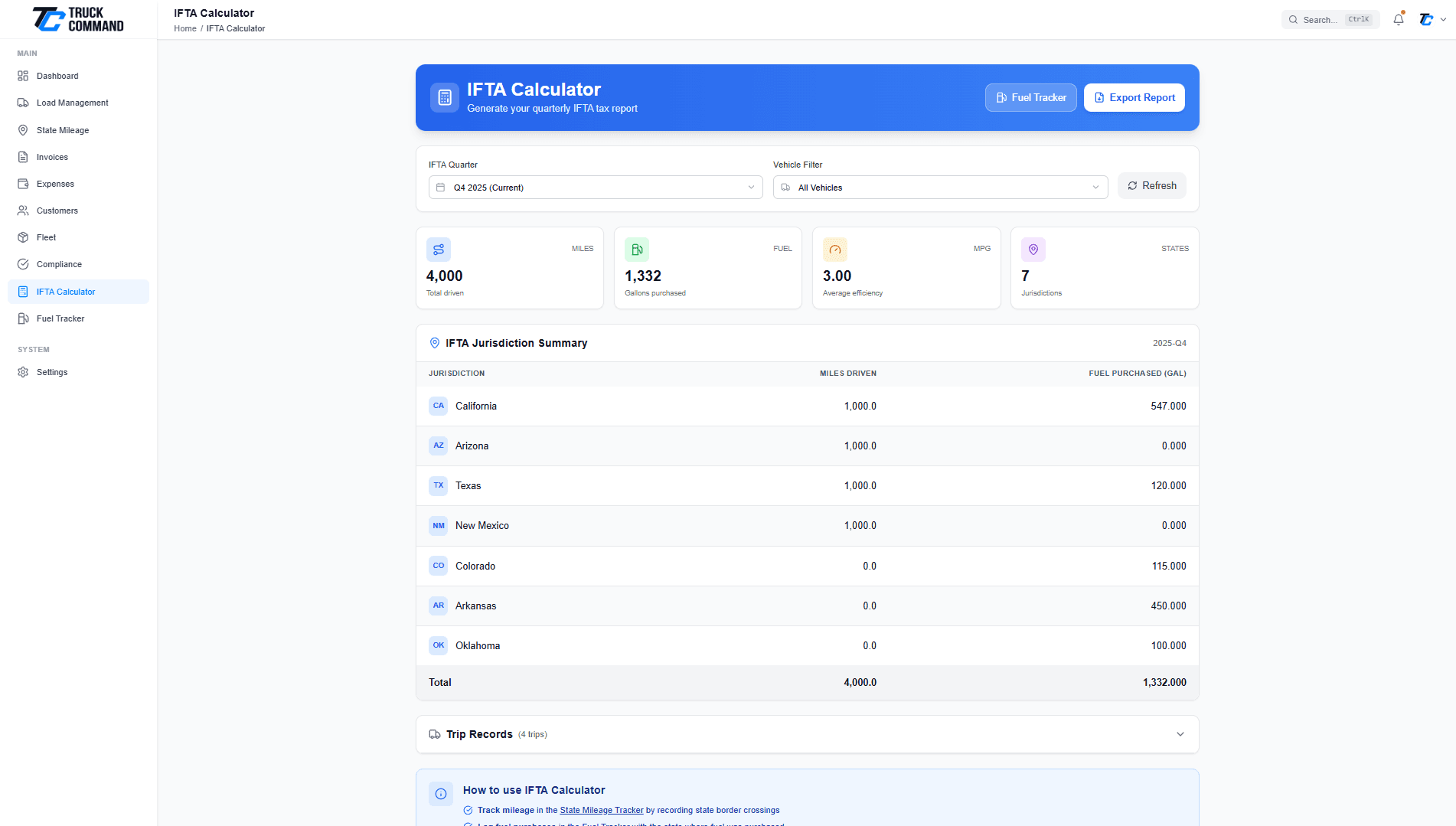

Complete Jurisdiction Summary

See your IFTA data for any quarter at a glance:

- Jurisdiction Breakdown: Miles and fuel for all 48 US states

- MPG Calculations: Fleet average MPG calculated automatically from actual data

- Taxable Gallons: Miles ÷ MPG for each jurisdiction calculated instantly

- Tax Due/Credit: Difference between taxable and purchased gallons shown per state

- Quarter Selection: Easily switch between quarters to view historical data

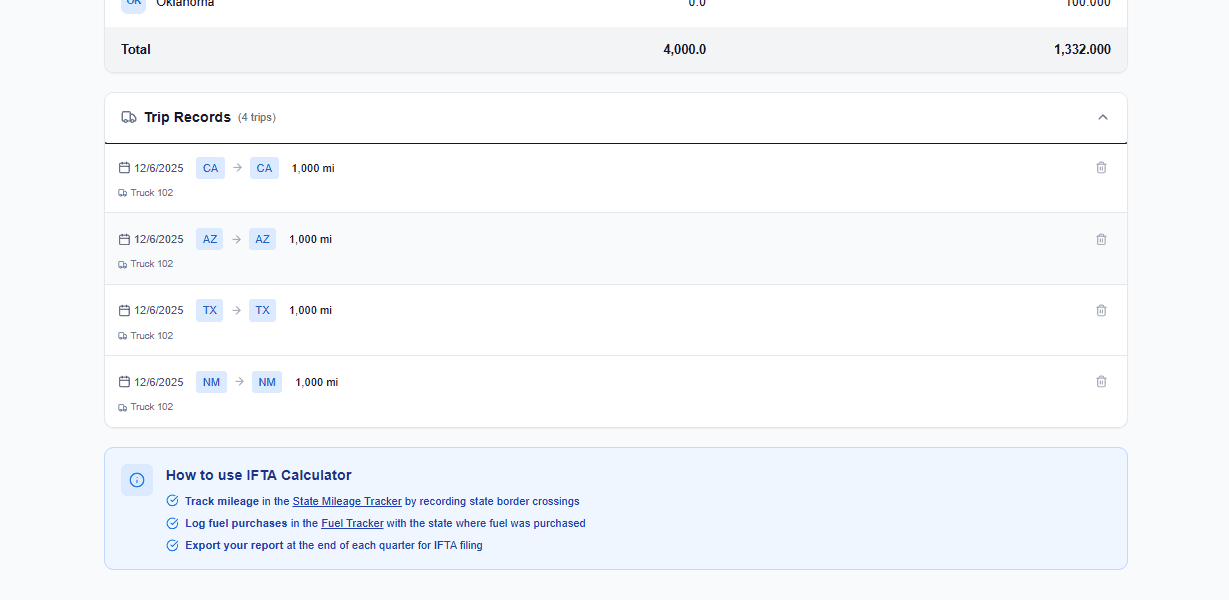

Detailed Trip Tracking

Every trip is documented for audit protection:

- Auto-Generated: Trip records created from completed loads with route details

- State Breakdown: Miles automatically split by jurisdiction based on route

- Vehicle Tracking: Each trip linked to specific truck for fleet reporting

- Manual Entry: Option to add trips manually when needed

- Date Filtering: View trips by quarter, month, or custom date range

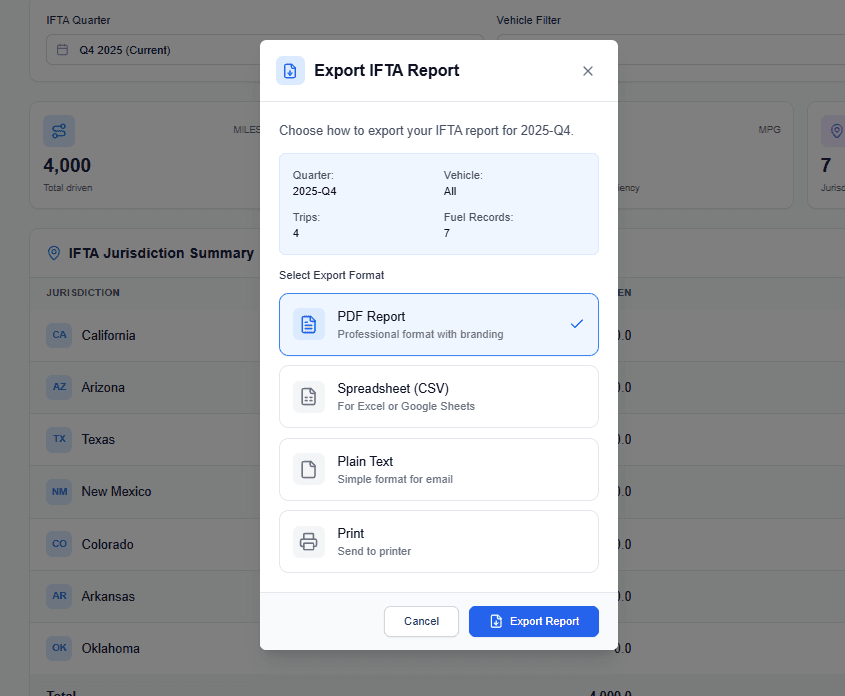

Filing-Ready IFTA Reports

Generate professional reports in the format your state requires:

- PDF Reports: Professional formatted reports with company information

- CSV Export: Data export compatible with state filing systems

- Summary Reports: High-level totals for quick reference

- Detailed Reports: Trip-by-trip breakdown for audit documentation

- Historical Access: Access any previous quarter's reports anytime

Integrated with Your Operations

IFTA data flows automatically from your daily operations

Load Management

Completed loads automatically generate IFTA trip records with accurate mileage by state from your route data.

Fuel Tracker

Fuel purchases logged in the fuel tracker sync directly to IFTA calculations with state detection built in.

State Mileage

Dedicated state mileage tracking ensures every mile is accounted for in your IFTA jurisdictions.

Truckers Love Our IFTA Calculator

See how other truckers have simplified their quarterly filing

“I used to spend an entire weekend every quarter doing IFTA paperwork. Now it takes me 30 minutes. The automatic mileage tracking from my loads is a game changer.”

James Rodriguez

Owner-Operator, JR Trucking

“The peace of mind knowing my IFTA data is accurate and audit-ready is worth every penny. No more stressing about calculation errors.”

Linda Chen

Fleet Manager, Chen Logistics

“As someone who runs through 20+ states, manually tracking was a nightmare. This system handles it all automatically. Best investment I've made for my business.”

Robert Taylor

Owner-Operator, Taylor Transport

IFTA Calculator FAQ

IFTA (International Fuel Tax Agreement) is a tax agreement between US states that simplifies fuel tax reporting for interstate carriers. If you operate a qualified motor vehicle in more than one IFTA jurisdiction, you must file quarterly IFTA reports to properly distribute fuel taxes to each state based on miles traveled.

When you complete loads in our dispatching system, the pickup and delivery locations are used to calculate miles driven through each state. This data automatically populates your IFTA records. You can also add manual trip entries for trips not logged through dispatching.

Our system provides the calculation framework and jurisdiction summaries. For actual filing, you'll use the tax rates from your base jurisdiction's IFTA filing system, as rates can change quarterly. Our reports provide all the mileage and fuel data you need for accurate filing.

Yes! Each truck in your fleet has separate IFTA tracking. You can view reports for individual vehicles or see combined fleet totals. This is perfect for small fleets that need to file one combined IFTA return.

You can edit any trip record to correct mileage or state information. The system will automatically recalculate your jurisdiction totals. We recommend reviewing your data before the quarterly filing deadline.

All IFTA data is stored indefinitely and accessible anytime. IFTA regulations require keeping records for 4 years, so having permanent access ensures you're always prepared for potential audits.

Have more questions about IFTA tracking?

Contact Our Support TeamReady to Simplify IFTA Forever?

Join thousands of truckers who've eliminated IFTA headaches with automatic tracking and easy quarterly filing.

No credit card required • 30-day free trial • Cancel anytime

Related Features

Complete your compliance toolkit with these integrated features

Fuel Tracker

Log fuel purchases with receipt storage. Fuel data syncs directly to IFTA calculations.

Learn MoreState Mileage

Track miles driven in each state for accurate IFTA reporting and compliance.

Learn MoreCompliance Tracking

Track license expirations, registrations, and regulatory deadlines in one place.

Learn More